Taxslayer 2018 Software Mac Download

- Taxslayer 2018 Software

- Taxslayer 2018 Software Mac Download Windows 10

- Taxslayer 2018 Software Mac Download Version

As if citizens didn’t have enough to worry about during the tax filing season, yet another data breach has claimed the identities of nearly 9,000 people. TaxSlayer announced a January 13th data breach, discovered during a routine security check, that released the personal identifiable information of many of its customers to an “unauthorized third party.”

Tax information is highly sought after, so much that even notoriously violent street gangs in the US have given up dealing drugs or robbery in favor of organized identity theft rings that steal tax refunds by filing fraudulent returns. The very image of tattooed, hardened criminals sitting around with their laptops and a ream of stolen identifying information would be laughable if it weren’t such a rampant crime. How large is this crime? Current estimates state that the IRS pays out billions of dollars a year in stolen tax refunds; in 2015 alone that number was $5.8 billion.

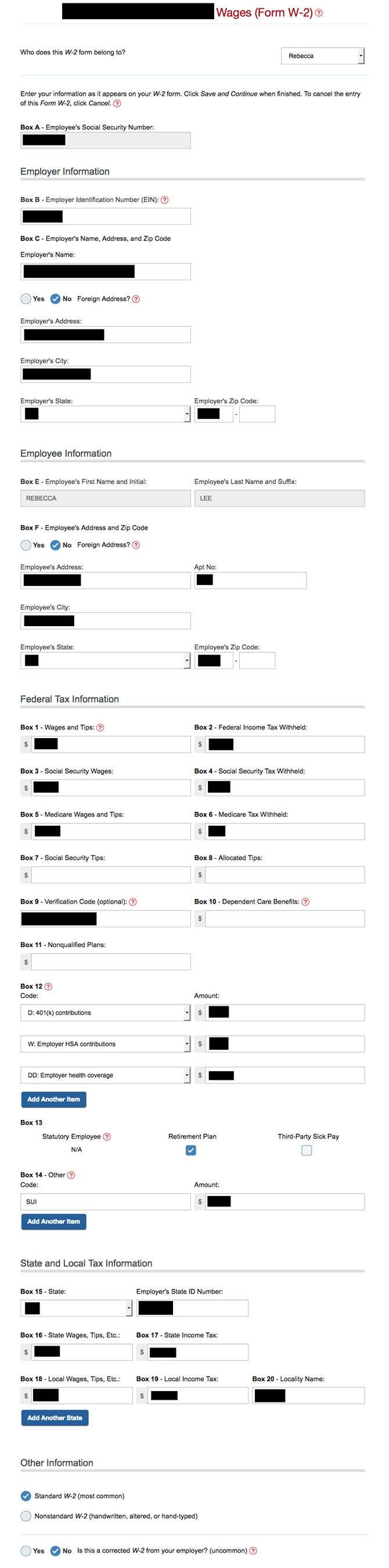

- You also need to make sure your IRS tax forms (and instructions) are the correct ones. For example, if you are filing a return for 2018, make sure your forms are also for tax year 2018. TaxSlayer can help you file a prior year return. TaxSlayer makes it easy to complete a prior year return for tax years 2016, 2017, and 2018.

- Global Nav Open Menu Global Nav Close Menu; Apple; Shopping Bag +.

Find TaxSlayer software downloads at CNET Download.com, the most comprehensive source for safe, trusted, and spyware-free downloads on the Web.

In a filed letter about the breach, which occurred between October and December of 2015, the company stated, “The unauthorized third party may have obtained access to any information you included in a tax return or draft tax return saved on TaxSlayer, including your name and address, your Social Security number, the Social Security numbers of your dependents, and other data contained on your 2014 tax return.”

TaxSlayer believes the hackers accessed their customers’ user names and passwords through another online service, but didn’t specify what that meant. They did point out that the TaxSlayer system was not compromised and had no discovered security flaws. In the letter that went out to affected customers, the company offered instructions for resetting the passwords, monitoring their credit reports for any unauthorized activity, and enrolling in free credit monitoring. It would also be wise for the victims to get their tax returns filed as quickly as possible in order to attempt to beat the hackers to it.

There is a lot to love about Pound & Reed’s book, A Tax Guide for American Citizens in Canada. In it, they correctly state that there is no tax software designed for US expats, and they write “There is software that helps Americans file their tax returns, but we think this makes things more confusing.” Perhaps this is part of what dates the book, because nowadays some personal tax software packages are genuinely helpful for subsets of US expats.* At a reasonable cost.

Here I review a number of the most popular personal tax-prep software packages and describe how well they worked for our tax returns in 2018. [Updated Jan 2020 as well.] Based on my research, the best tax software for US expats is TaxAct. It is worth the modest cost. And for Canadian returns, donation-supported StudioTax is the best.

Desired features

Each piece of commercial personal tax software has a unique set of features. The features that we need and desire are:

Supported forms

First—and most importantly—is support for all the unusual forms required for expats. We will be able to eliminate several options simply because they do not support enough forms.

Which forms specifically? Certainly Forms 2555 and 1116, for excluding or taking foreign tax credits, or both. Compliance Form 8938, and other various foreign forms such as 3520, 8621, and 8858 are also encouraging to see.

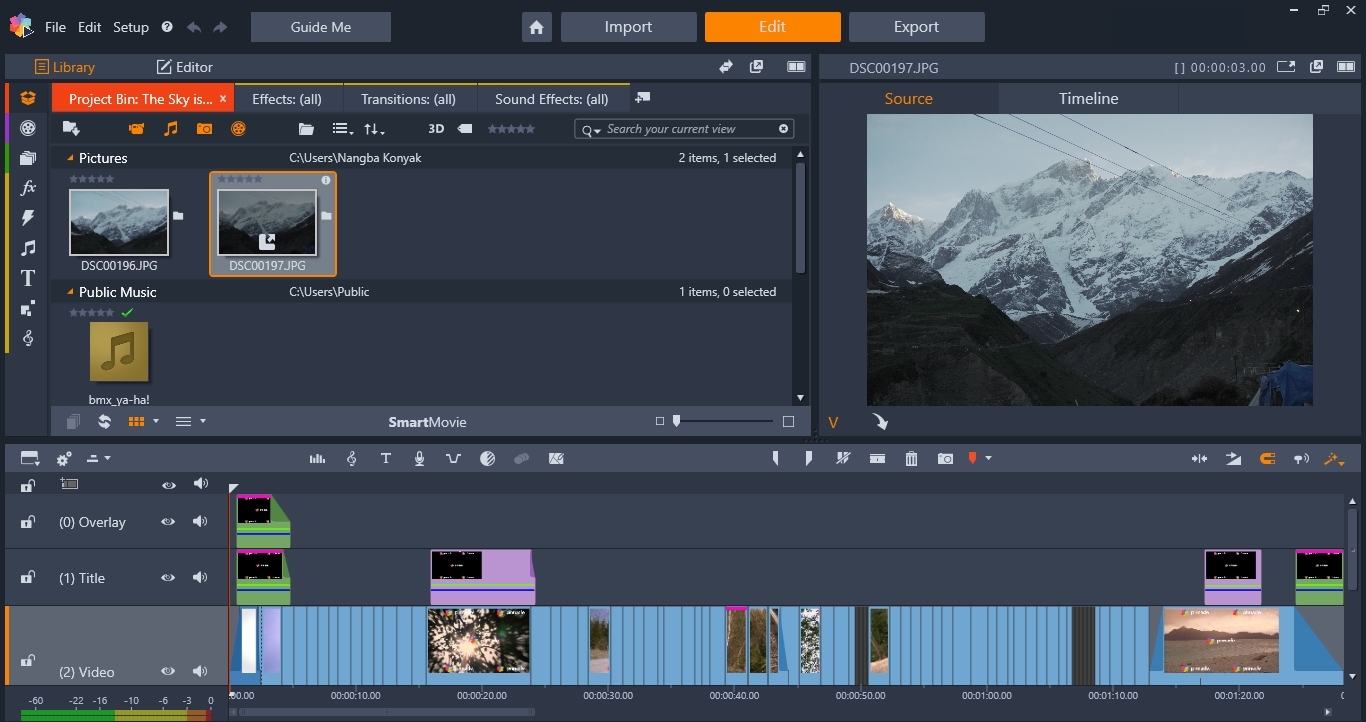

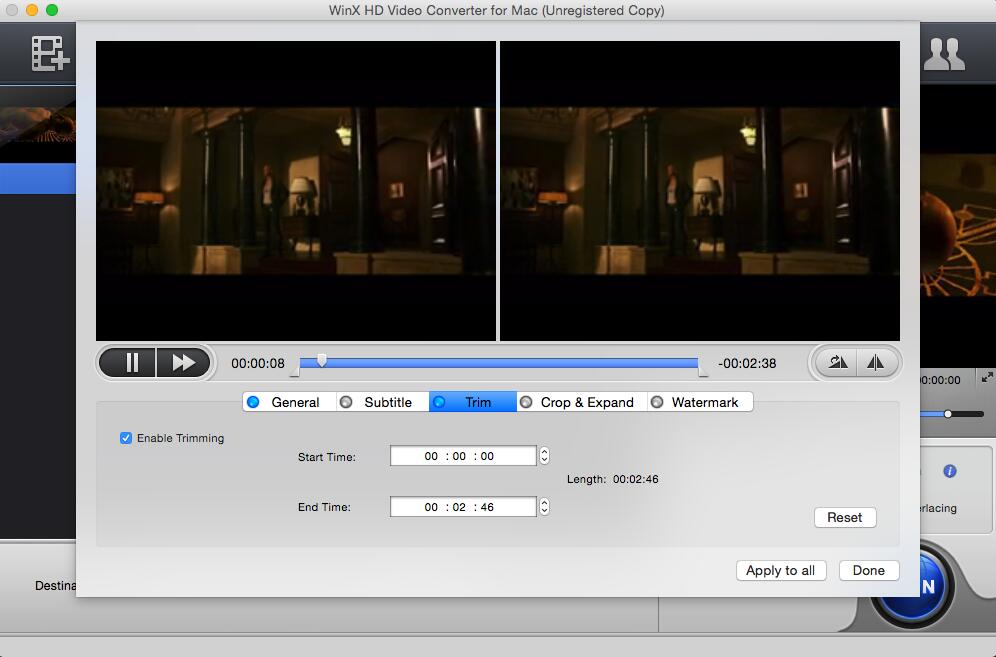

Downloadable, not online only

Second—this is more of a want than a need—I strongly prefer software that I can download to my local machine. Unlike people living in the States, most US expats do not have simple tax returns that can be done in one session. Websites that require logins, passwords, automatic time-outs, and two-factor authentication make me feel secure, but also waste a lot of time.

Hence I prefer software that I can download to my local machine and just have it open to work on for as long as I wish. This also probably reduces the amount of data mining done by the software companies.

A secondary issue that arises from this feature is software that runs on both PCs and Macs.

Customer service

The third feature I want is adequate customer support. Non-existent or—even worse—dismissive customer support is a big downside. When I’m learning about tax forms and how to run a piece of software for the first time, I want patient customer support people who think through responses and can answer my questions.

Or, better yet, I want software that is so helpful and intuitive that I don’t even need customer support.

Cost

The fourth feature is cost. Oddly, for a blog that touches on frugality, this is at most of minor importance. The reason is that most of the tax software packages cost about the same amount, in contrast to an accountant who charges $5000. Whether I pay $80 or $100 for a piece of software is more or less irrelevant. (Nevertheless, if we can save $20 for an identical product, we will not waste the money!)

With these four features in mind, we will evaluate the different tax software packages available to us.

Canadian tax software

As US citizens in Canada, we have the pleasure (!?!?) of doing taxes in two countries every year. So we are familiar with tax software on both sides of the border. We will begin with the Canadian side.

StudioTax is the way to go. It has all the features we want. It downloads to your computer—both Mac and PC—and they describe that there are no privacy or data-mining concerns. Furthermore, StudioTax can connect via the internet to the CRA database to grab all the tax slips. This is a feature I did not even mention above because such a concept is so unexpected by Americans who are used to dealing with the 19th-century style operations of the IRS. After the first year of using Studio Tax, I’m about half done with my return after about 10 clicks of the mouse.

I can confirm that StudioTax’s customer support is great. A couple weeks ago I emailed them a question about how to insert foreign tax credits and they replied overnight with some screenshots of exactly how to do it.

StudioTax relies on donations and—because they help save me a ton of money by avoiding an accountant—I send a donation each year I use them. Thank you StudioTax!

US tax software

Here are all the software packages I evaluated: FreeTaxUSA, TurboTax, 1040.com, TaxSlayer, and TaxAct.

Below I evaluate each of these commercial packages systematically.

FreeTaxUSA

FreeTaxUSA seems like a great service for a lot of US taxpayers. Unfortunately, while they do support Foreign Tax Credits on Form 1116, they explicitly donot support Form 2555, which US expats often use to exclude foreign earned income. In addition, FreeTaxUSA does not currently support the PFIC form, Form 8621.

Because of this lack of support for these critical forms, we eliminate FreeTaxUSA as a viable option for most US expats.

[Jan 2020 note]: There seem to be no changes from last year.TurboTax

TurboTax is probably the king of the space in personal income tax returns. Like most such providers, they advertise a so-called “free” option but then charge for state returns and try to up-sell most taxpayers.

TurboTax supports many more forms than FreeTaxUSA. However, evenTurboTax does not support Form 8621, which is needed for PFIC disclosures.

Furthermore, TurboTax has downloadable, online, and even a mobile app in terms of software options. They support Mac and PC, and even still ship CDs if you—for reasons unknown—do not want the convenience of a download.

The prices on TurboTax range from about US$60 to US$120.

TurboTax is a viable option for some US expats, specifically those who do not own any foreign mutual funds or ETFs that would trigger PFIC reporting.

Taxslayer 2018 Software

[Jan 2020 note]: There seem to be no changes from last year.1040.com

I tried 1040.com. I really wanted to like it because it came highly recommended by The Wealthy Accountant and it seems to support every single IRS form. The cost, at about $75 for federal + state, was a bit lower than other companies.

1040.com is an online-only product, which is not my preference. Their interface requires a password and two-factor authentication every time, plus it has an auto-timeout after about 10 minutes. This was irritating but not a deal breaker.

The downsides were substantial, though. First of all, if you have to file the foreign account disclosure form, Form 8938, then you must also file the FBAR through their system. I did not know this ahead of time, and I had already filed by FBAR. Hence, using 1040.com would have triggered—at best—duplicate FBAR filing. In addition, 1040.com could not understand why I was trying to file a state return since my address was from outside the US. As a cross-border commuter, I have earned income from inside NY and need to file a NY state tax return.

There were some ugly workarounds to those two issues, but what broke the deal for me was several absolutely unacceptable customer service experiences. I initiated 3 or 4 chat sessions to deal with the above issues, and the support personnel (maybe they were bots?) were dismissive and really could not understand my needs and confusion. There are a lot of other products out there, so 1040.com is gone to me.

TaxSlayer

TaxSlayer supports some but not all of the foreign forms. Like TurboTax, TaxSlayer does not support for Form 8621.

While slightly lower cost than some of the products above (max cost of about US$85), TaxSlayer is an online-only product.

Taxslayer 2018 Software Mac Download Windows 10

There is a subset of US expats for whom TaxSlayer is a good option: People without foreign mutual funds or ETFs. In that space, TaxSlayer competes head-to-head with TurboTax. Because we personally owned foreign ETFs, we did not use TaxSlayer.

[Jan 2020 note]: There seem to be no changes from last year.TaxAct

Confession time. I had never heard of TaxAct until a couple of months ago.

TaxAct supports all the forms we need, including Form 8621. Furthermore, TaxAct allows me an either/or/both with the two compliance forms of the FBAR (114) and the Form 8938. These are a big advantages. In the future I would like to see TaxAct support even more of the foreign forms, such as Form 8858.

TaxAct has online and downloadable products, and the max price is just under $120. Thus the cost is about the same as other products.

Encouragingly, despite the learning curve with the software, I have yet to need to contact customer support about anything.

I bought the download product and have used it this year (2018) to file our US and NY returns. It was fairly straightforward. The only quirk I encountered (which the software notified me about) was that capital gains reported on Form 8621 do not automatically flow through to Schedule D. This needs to be done separately, which was a minor inconvenience.

TaxAct’s software also had no problem understanding that I commute to NY and therefore need to file a NY state return even though I am not a resident or part-year resident. Perfect.

[Jan 2020 note]: There seem to be no changes from last year.TaxAct is the winner!

Taxslayer 2018 Software Mac Download Version

In our case, the best tax software for US expats is TaxAct. We will be using it to do our US tax returns for 2019 just as we did for 2018.

Non-disclaimer disclaimer

None of the above companies are affiliates of this blog; we receive no compensation from any of them. The comments above are just my honest research and experiences. If that changes, I will update this disclaimer in the future.

*Furthermore, Pound and Reed refer readers to www.freefillableforms.com, which no longer exists. The updated site, www.freefilefillableforms.com contains a limited set of Forms. (For example, Form 8621, for PFICs, is not supported.) In addition, there are no state forms and some expats will have to file a state return as well.